Basics of Eligibility for Within Grade Increases (WIGI)

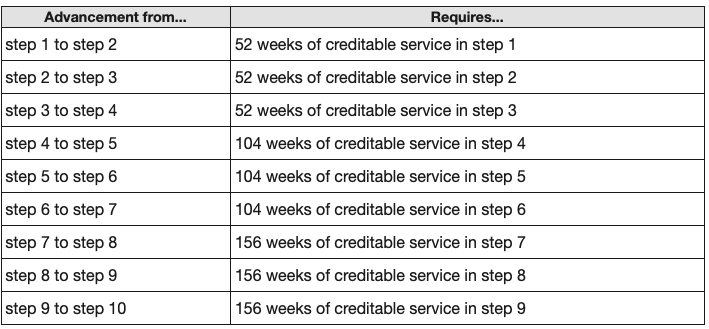

WIGIs apply to federal general schedule employees who occupy permanent positions and are at less than the maximum rate of their grade. See, 5 CFR 531.402 (a). Contrary to wide-spread belief, Within Grade Increases (WIGI), also known as a “step increase”, are not automatic pay raises for federal employees. Instead, a WIGI is a periodic step increase within an employee’s grade, with specific waiting periods as indicated in the chart below. The granting, delay, or denial of a WIGI is subject to law and regulation at 5 USC 5335 and 5 CFR Sections 531.401-.414. and 5 CFR 531.403. In essence, law requires that a federal employee “earn” the step increase through their job performance. If the supervisor of an employee determines the employee is not performing at an Acceptable Level of Competence (ALOC), he or she must (statutorily required) deny (delay) the scheduled WIGI until such time the supervisor can certify that the employee is performing at an ALOC. There is no discretion in this regard. The ALOC determination is made via the performance rating of record. This rating is controlling for this purpose.

There are three general threshold requirements for earning a WIGI:

- The employee’s performance must be at an Acceptable Level of Competence (ALOC), which is when the employee’s most recent rating of record is “fully successful” or better.

- The employee must have already completed the required waiting period for advancement to the next higher step of the grade of her position.

- The employee must not have received an equivalent increase during the waiting period.

Delay and Denial of Within Grade Increases (WIGI)

Typically, a delay in otherwise scheduled Within Grade Increases (WIGI) is commonly referred to as a denial. This is because the same WIGI that is denied may be approved later once regulatory requirements are met. The primary causation we encounter in connection with WIGI denials is that the employee is allegedly not performing at an Acceptable Level of Competence (ALOC). More specifically, the employee’s rating of record is not at a “fully successful” level or better. It is important to note that a “minimally satisfactory” level of performance is not “fully successful” or better and does not meet the ALOC determination requirement.

There are many variables other than performance that may affect the granting of otherwise scheduled Within Grade Increases (WIGI) and each situation likely requires analysis based on its own unique facts and circumstances. Accordingly, you should seek professional consultation to consider your unique facts and circumstances. These variables involve, waiting periods, whether a Quality Step Increase (QSI) was granted and when, extended absences from work, details away from position of record, service credit received by employee under back pay provisions, insufficient length of service for the employee to demonstrate an ALOC due to authorized activities of official interest to the agency that are not otherwise subject to appraisal, extended training away from position of record even if the training is related to the position of record, performance standards were never issued to the employee, if the employee has not served in any position for the minimum agency performance period to evaluate performance, and many other reasons. Additionally, for agencies not covered by 5 USC Chapter 43, and employees in positions excluded from 5 USC 4301 (such as Foreign Service employees and physicians, dentists, nurses, and other employees of the Veterans Health Administration paid under 38 USC Chapter 73), ALOC determinations are based on the agency specific performance appraisal requirements, which may be different than those for other employees. See, 5 CFR 531.409 (b).

Seeking Reconsideration of a Delayed Within Grade Increase (WIGI)

When an ALOC determination is delayed, the employee must be formally notified of the delay and the subsequent extension of the appraisal period. This typically takes the form of a Performance Improvement Plan (PIP) or similarly worded scheme such as an Opportunity Period (OP) or Performance Assistance Plan (PAP). The affected employee must be informed of the specific performance requirements applicable to an ALOC. Subsequently, an ALOC determination must be made based on the employee’s rating of record completed at the conclusion of the extended appraisal period. See, 5 CFR 531.409 (c)(2). Usually, at the end of any performance assistance period as noted above. The affected employee must also be provided instructions for seeking reconsideration (appeal rights). Typically, an employee may request reconsideration of a negative determination by filing a written response to the determination with the reasons the agency should reconsider the determination. The request must be filed within 15 days of receiving the notice of determination. See, 5 CFR 531.410 (a)(1).

If an agency fails to properly notify the affected employee of reconsideration rights or the employee can demonstrate he was prevented by circumstances beyond his control from timely requesting reconsideration, the time limit for requesting reconsideration may be extended. 5 CFR 531.410 (b). See also, Jack v. Department of Commerce, 98 MSPR 354 (MSPB 2005).

Conclusion

The prevalent public perception that federal employees lack accountability and frequently receive excessive arbitrary pay raises is inaccurate. The entire system for federal workforce administration, unlike political appointees, is based on provable and defensible merit. Hence, the term “Merit System”. A system which was created out of concern for the public interest. This false perception held by the public arises from deliberate misrepresentations by specific political factions and their adherence to certain ideological principles, regardless of facts. These groups either deliberately fabricate information or exhibit a profound, if not deliberate, lack of understanding regarding the facts surrounding government workforce administration. Policy and law concerning Within Grade Increases proves that point.

BOOK A FREE CONSULTATION | WHAT WE DO | CONSULTING QUESTIONS | FEE STRUCTURE

The contents of this website (InformedFED.com) are intended to convey general information only and not to provide legal advice or opinions. Consultants at InformedFED are not attorneys. They are senior level practitioners of employee labor relations and EEO. The contents of this website, and the posting and viewing of the information on this website, should not be construed as, and should not be relied upon for, legal or employment advice in any particular circumstance or situation. The information presented on this website may not reflect the most current legal or regulatory developments. No action should be taken in reliance on the information contained on this website and we disclaim all liability in respect to actions taken or not taken based on any or all of the contents of this site to the fullest extent permitted by law. InformedFED is comprised of independent senior level practitioners and consultants who are not employees of InformedFED.